Bitcoin Etf : Kae5gyqfrukw M

Bitcoin is a digital currency that employs blockchain technology to facilitate value transfer whereas a Bitcoin ETF is a tradable financial instrument whose value is pegged to the value of the Bitcoin cryptocurrency. Major achievement for the crypto industry there is a sensation of euphoria in.

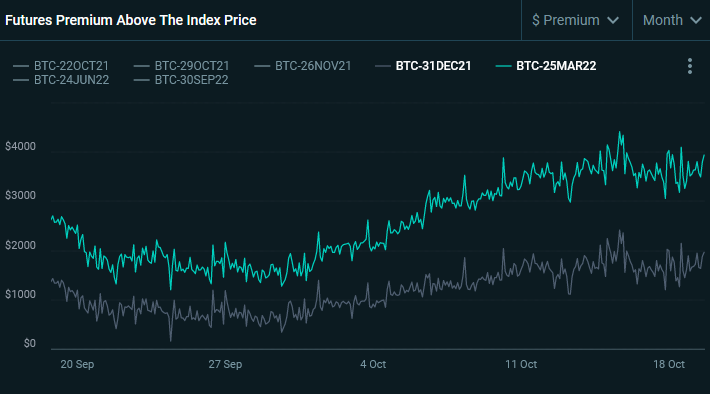

The ETF tracks bitcoin prices through futures contracts traded at the CME.

Bitcoin etf. The cryptocurrency has jumped more than 10 over the past week and was trading above 61000 on. Nun wurde mit dem BTCetc Bitcoin Exchange Traded Crypto ISIN. This morning Bloombergs James Seyffart revealed that the ProShares Bitcoin Strategy ETF.

New York CNN Business Cryptocurrency investors finally got what theyve been clamoring for as the first bitcoin-linked exchange-traded fund. Bitcoin Starts October with Sharp Rally. Der Bitcoin kratzt wieder an seinem Allzeithoch von rund 64800 US-Dollar.

Bitcoin tops 60000 for first time in six months as traders bet on ETF approval Published Fri Oct 15 2021 525 AM EDT Updated Fri Oct 15 2021 449 PM EDT Ryan Browne Ryan_Browne_. Not all hope is lost for bitcoin ETF believers Grayscale Investments says. This allows investors to buy into the ETF without going through the complicated process of trading.

The first Bitcoin ETF in the United States begins trading on Oct. A bitcoin ETF is one that mimics the price of the most popular digital currency in the world. Experts dont actually seem that.

Anticipation of the ETFs listing appeared to boost the price of bitcoin over the past week. A futures-based Bitcoin ETF is coming and not in a theoretical sense either. Additionally while Bitcoin can be bought sold or traded on cryptocurrency exchanges Bitcoin ETFs currently can only be accessed through the traditional bourses.

Grund ist die bevorstehende Genehmigung eines futurebasierten ETFs an. A bitcoin futures ETF allows the broader public to get involved without many of the problems around owning the virtual currency. The first bitcoin ETF finally begins trading.

That means that by purchasing a bitcoin ETF an investor would be indirectly purchasing bitcoin as he or she would be holding the bitcoin ETF in a portfolio as opposed to the actual digital currency itself. Bitcoin ETF is no longer an if but a when Grayscale Investments says. A Bitcoin ETF such as the one proposed by the Winklevoss twins would have the digital currency bitcoin as an underlying asset.

The SEC has rejected every previous application to. That makes it one of the top ETF debuts in history. DE000A27Z304 ISIN kopiert endlich ein sehr ähnliches Produkt auf den Markt gebrachtEs handelt sich zwar im engeren Sinne nicht um einen ETF aber dennoch erfüllt dieses Produkt wichtige Anforderungen.

As we were leaving a historically underperforming September Bitcoin rapidly recovered. Definition Bitcoin ETF. Three other Bitcoin ETFs are.

The first US. A futures-based ETF tracks futures contracts rather than the price of an asset. The approval of a Bitcoin Exchange Traded Fund ETF in the US.

This cryptocurrency is built on the foundational principles of blockchain which allows for a recorded inemutable decentralized ledger of transactions to be maintained on a distributed network with no single point of failure. Delayed once again now is a good time to explore what would happen if either Bitcoin ETF or futures-based Bitcoin ETF were to launch. Later that day the price of bitcoin soared past its all-time high of 64895 to a new record of 66975.

As a result a futures-based bitcoin ETF would track bitcoin futures contracts not the price of bitcoin itself. Bitcoin ETF Check Whats Next For BTC. Bitcoin futures-based exchange-traded fund began trading on Tuesday sending bitcoin to a six-month high and just off its all-time peak as traders bet the ETF could boost.

Bitcoin is a cryptocurrency created in 2009 by an unknown figure under the alias Satoshi Nakamoto. However as the ETF would closely track the price of bitcoin for the. Dies ermöglicht es Anlegern sich in den ETF einzukaufen ohne den komplizierten Prozess des Bitcoin-Handels selbst zu durchlaufen.

Industry participants have long sought to launch a bitcoin ETF with Gemini founders Tyler and Cameron Winklevoss first seeking an ETF in 2013. Rising from 41k on September 28th to 47k. Different actors in the crypto space have tried to receive the greenlight from that countrys regulator SEC for little less than a decade.

For years dozens of companies have applied to have an ETF approved by the SEC. Lange Zeit haben Anleger auf einen Bitcoin-ETF gewartet. Ein Bitcoin-ETF ist ein ETF der den Preis der populärsten Kryptowährung der Welt nachahmt.

Bitcoin Futures Etfs Are Here This Week In Crypto Oct 18 2021

Bitcoin Etf Erster Borsengang Eines Bitcoin Fonds In Usa Verlauft Gerauscharm Nachricht Finanzen Net

Breaking Proshares Bitcoin Futures Etf Bito Becomes Fastest Etf In History To Reach 1 Billion

Krypto Fonds Trendwende Oder Blockade Sec Gibt Aussicht Auf Bitcoin Etf Grayscale Kritisiert Einschrankungen Nachricht

/golden-bitcoins-991448988-7f254d7a2e0b408895d784b82dd58950.jpg)

First Bitcoin Etf Begins Trading

What Is A Bitcoin Etf Coindesk

Bitcoin Etfs May Finally Make Their Debut Sort Of

Bitcoin Etf Debut Lasst Allzeithoch Wackeln Experten Warnen Aber Dennoch Focus Online

Proshares Bitcoin Etf Enters As Second Most Traded Etf In History